Choose exactly what accountancy support you need with our new tool and get a quote in 60 seconds. Tax forms Taxation in the United Kingdom. Sending you flowers if you're ill, for instance, might be a nice gesture from a thoughtful boss. Is this page useful? I also draw your attention to some important information regarding certain benefits in kind and expenses, and the completion of Forms P11D:.

| Uploader: | Samur |

| Date Added: | 3 June 2014 |

| File Size: | 24.43 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 10793 |

| Price: | Free* [*Free Regsitration Required] |

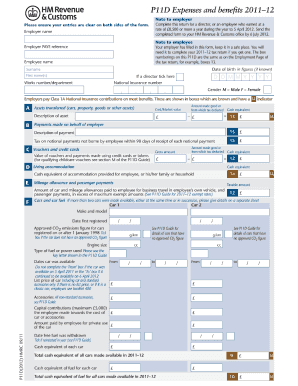

This has now been replaced by an exemption system, whereby the majority of business expenses incurred personally by company employees no longer need to be recorded on a P11D form. As with most tax filings, HMRC is ready and waiting with the penalty hammer should you file late or incorrectly.

If you need to pay loan interest on an overdrawn DLA, then the company will also need to pay Class 1A NICs on the interest payments the current rate is Is this page useful? Thank you for your feedback.

What is a P11D form?

We also use non-essential cookies to help us improve government digital services. This article does not cite any sources.

If you stay on pp11d of your accounts, filing your Foorm will be a walk in the park. We're talking about the little extras you get in addition to your salary, like company cars or private medical cover. Not absolutely everything has to be declared, but the list of things that do is pretty long. When do I need to file a P11D? There are currently 14 sections on the P11D: Subscribe To Our Newsletter Join our mailing list to receive the latest news and updates from our team.

Useful tools and resources.

P11D - Wikipedia

In practice, that generally means considering whether the tax they'd get is enough to justify the admin burdens involved on both sides. If you require any further information regarding the completion of forms P11D, or whether certain benefits in kind are still cost effective, please speak to your Lambert Chapman LLP Partner or your usual Tax Department contact. What is a P11D b form? Use our online tools to p11d out if you're owed money by HMRC.

There is the potential for substantial penalties to be imposed if P11D returns are not completed or are incorrectly returned. Cheap or interest-free loans. Build your own online accountancy package Join 11, clients who trust our advice, support, and leading accountancy software for their business.

There's no specific threshold for this, so it tends to be considered case-by-case. If you use assistive technology such as a screen reader and need a version of this document in a more accessible format, please email different. In addition to the examples above, you might also be getting things like: Employers need to be very sure to keep the details accurate, though.

Generally speaking, any items the company pays for and that the employee benefits from need to be included on the P11D form. Home phone usage The cost of calls made by employees from their home telephone or personal mobile where the company has repaid the expense can be overlooked. Basically, anything you get from your employer that isn't part of your basic salary can count as an flrm benefit. You can also download a selection of invoice templates for all business types.

Act Now! Form P11D – Tax on Company Benefits | Lambert Chapman

You should ensure that the correct rate is used, as any payment by an employee to reimburse the employer for private fuel in a company car must at least equal the amount based on the published rates or the full Fuel Benefit foorm will apply. The exact rules covering what has to be listed in a P11D are complicated, and change from time to time.

If you have received a P11D benefits statement form and are unsure as to what procedure to undertake, please contact HMRC or please contact your employer or place of work for enquires.

Retrieved from " https: Toggle navigation Most cash equivalents are straight forward being the amount the employer pays for the provision of a service less any amount the employee reimburses to their employer.

No comments:

Post a Comment